do you have to pay sales tax when selling a used car

Pay the sales tax. If you purchase a car in one state and then move to another you might still have to pay taxes.

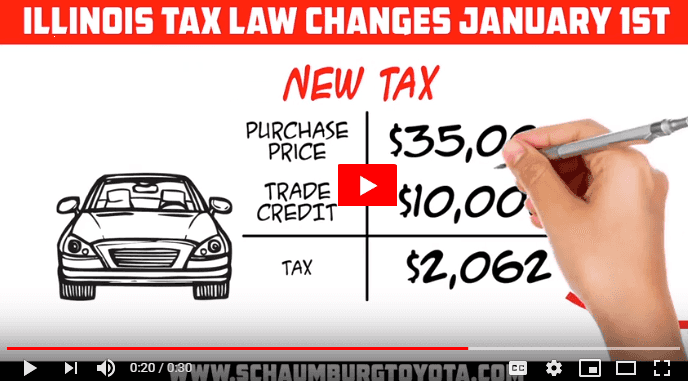

Car Dealer Frequently Asked Questions Schaumburg Toyota

However if you purchase your vehicle 90.

. If you sell your car for more than you originally paid for it you will owe capital gains tax. The buyer is responsible for paying the sales tax. If youre a buyer transferee or user who has title to or has a motor vehicle or trailer youre responsible for paying sales or use tax.

You can avoid paying sales tax on a used car by meeting the exemption circumstances which include. Although a car is considered a capital asset when you originally purchase it both state. Prove your vehicle registration is exempt from sales tax.

In fact a new vehicle is. So if your used vehicle costs 20000. Correct answer Yes you must pay vehicle sales tax when you buy a used car if you live in a state that has sales tax.

Sales tax varies by county. Typically most states charge between 5 and 9 for their sales tax says Ronald Montoya senior consumer advice editor at Edmunds. The title fee is 15.

Pay Fees and Sales Tax. Motor vehicle or trailer sales or use tax. If I Sell My Car Do I Have to Pay Taxes.

625 sales or use tax. Yes used cars do have a sales tax and so you will have to pay a sales tax when you buy a used car. The short answer is maybe.

Theres a 5 late fee if you apply more than 30 days after buying the car. If a vehicle is purchased from an Indiana dealership the dealer. When Do You Pay Sales Tax On A Used Car.

For example theres a state sales tax on the purchase of automobiles which is 725 and additional county taxes apply. There are some circumstances where you must pay taxes on a car sale. You also want to trade in your old car.

You will register the vehicle in a state with no sales tax because. That is assuming that you live in a State which implements sales tax which is. How much tax do you pay on a car in Mississippi.

When you purchase a vehicle in Indiana you must pay sales tax on the purchase price of the vehicle. The maximum tax that can be owed is 475. That means youll be taxed only on.

You do not need to pay sales tax when you are selling the vehicle. Prove that sales tax was paid. Toyota of Naperville says these county taxes are far.

If you buy a car in New Jersey then youll need to pay sales tax and other fees when you transfer ownership. Thankfully the solution to this dilemma is pretty simple. Mississippi collects a 3 to 5 state sales tax rate on the purchase of all vehicles.

If you buy another car from the dealer at the same time many states offer a trade-in tax exemption that lowers the amount of sales tax youll pay in the trade. Do I Have to Pay Sales Tax on a Car When I Move. If for example you.

When you register a vehicle in New York at a DMV office you must either. If the dealer offers you 25000 for it you now owe the dealer the 20000 balance for the new car. Sales and Use Tax.

Do You Qualify For A Vehicle Sales Tax Deduction

Understanding California S Sales Tax

Sales Taxes In The United States Wikipedia

Taxes When Buying Or Selling Cars At Thompson Sales

Price Jump For Used Cars Results In Boost In Michigan Sales Tax Collected Michigan Thecentersquare Com

Selling To A Dealer Taxes And Other Considerations News Cars Com

Colorado Sales Tax Rate Rates Calculator Avalara

502 Bad Gateway4 Reasons To Use Your Tax Return To Buy A Car Legend Auto Sales Blog

How To Close A Private Car Sale Edmunds

Sell Your Car In Cincinnati Oh Subaru Of Kings Automall

Iowa Vehicle Sales Tax Fees Calculator Find The Best Car Price

Does The Seller Have To Pay Tax On A Vehicle When He Sells It

X Club Xclub Fbr Issues Sales Tax Notification On Used Cars Sale Give Your Suggestions In Comments Section Facebook

Can A Dealership Charge Motor Vehicle Tax After Car Purchase Abc News

Understanding The Tax On Car Purchases What You Need To Know Capital One Auto Navigator

Fl Car Dealer When Is A Sale Tax Exempt James Sutton Cpa Esq

/GettyImages-160143914-490a0fd99380456fb809d575104c4719.jpg)