kentucky income tax calculator

Kentucky imposes a flat income tax of 5. Kentucky Income Tax Calculator 2021.

Reciprocal Agreements By State What Is Tax Reciprocity

The bracket threshold varies for single or joint filers.

. So the tax year 2022 will start from July 01 2021 to June 30 2022. Annual 2019 Tax Burden 75000yr income Income Tax. After a few seconds you will be provided with a full breakdown.

If you make 70000 a year living in the region of Kentucky USA you will be taxed 11753. Tax Information Sheet Launch Kentucky Income Tax Calculator 1. The following steps allow you to calculate your salary after tax in Kentucky after deducting Medicare Social Security Federal Income Tax.

Kentucky Income Tax Calculator 2021. This tool was created by 1984 network. Tax Year 2019 Kentucky Income Tax BracketsTY 2019 - 2020.

If you make 102000 in Kentucky what will your salary after tax be. Easily E-File to Claim Your Max Refund Guaranteed. Overview of Kentucky Taxes.

The Kentucky tax calculator is updated for the 202223 tax year. Know what your tax refund will be with FreeTaxUSAs free tax return calculator. To use our Kentucky Salary Tax Calculator all you have to do is enter the necessary details and click on the Calculate button.

Please click here to see if you are required to report Kentucky use tax on. Easily E-File to Claim Your Max Refund Guaranteed. Our income tax and paycheck calculator can help you understand your take home pay.

These types of capital gains are taxed at 28 28. Kentucky use tax may be due on internet mail order or other out-of-state purchases made throughout the year. How to Calculate Salary After Tax in Kentucky in 2022.

Use ADPs Kentucky Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees. If you make 125000 a year living in the region of Kentucky USA you will be taxed 27124. Kentucky has a flat income tax of 5 All earnings are taxed at the same rate regardless of total income level.

Your average tax rate is 1681 and your marginal. Just enter the wages tax withholdings and other information required. This calculator assumes that none of your long-term capital gains come from collectibles section 1202 gains or un-recaptured 1250 gains.

The Kentucky income tax rate is 5 for all personal income. Ad Calculate Your 2022 Tax Return 100. Your average tax rate is 2038 and your marginal.

The tax rate is the same no matter what filing status you use. If you make 169500 in Kentucky what will your salary after tax be. If you would like to help us out donate a little Ether cryptocurrency to.

If you make 95500 in Kentucky what will your salary after tax be. As part of the 2022-23 Budget the NSW Government announced that first home buyers purchasing properties up to 15 million will be provided the option to pay an annual property. Ad Calculate Your 2022 Tax Return 100.

Aside from state and federal taxes many Kentucky. Kentucky tax year starts from July 01 the year before to June 30 the current year. Calculating your Kentucky state.

Our income tax and paycheck calculator can help you understand your take home pay. The KY Tax Calculator calculates Federal Taxes where applicable Medicare Pensions Plans FICA Etc allow for. Your average tax rate is 1198 and your marginal.

Calculate your net income after taxes in Kentucky. If you make 199500 a year living in the region of Kentucky USA you will be taxed 50491. Select Region United States.

Kentucky Income Tax Calculator 2021. Kentucky Income Tax Table Tax Bracket Single Tax Bracket Couple Marginal Tax Rate. Know what your tax refund will be with FreeTaxUSAs free tax return calculator.

Our income tax and paycheck calculator can help you understand your take home pay.

Property Tax Calculator Smartasset

Esmart Paycheck Calculator Free Payroll Tax Calculator 2022

Chapter 7 Means Test Kentucky O Bryan Law Offices

States With No Income Tax H R Block

Income Tax Calculator Estimate Your Refund In Seconds For Free

Tax Withholding For Pensions And Social Security Sensible Money

Uk Law Students Provide Free Tax Preparation Starting Feb 20 Uknow

Kentucky Income Tax Rate And Brackets 2019

Nanny Tax Payroll Calculator Gtm Payroll Services

How To File The Inventory Tax Credit Department Of Revenue

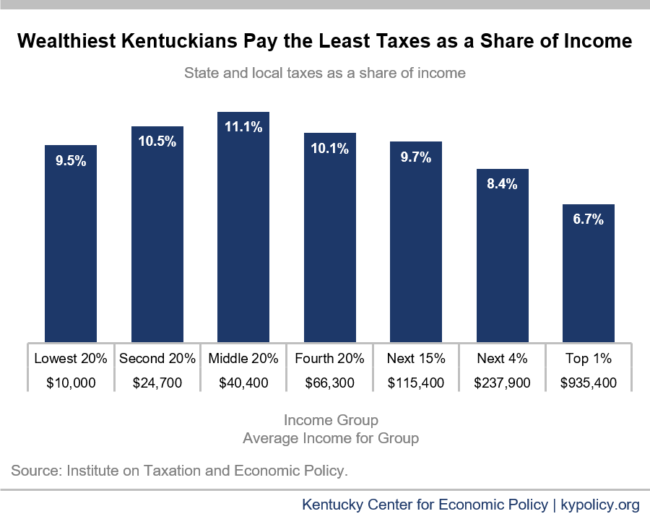

New Report Wealthiest Kentuckians Pay The Lowest Tax Rate And The Problem Is Worsening Kentucky Center For Economic Policy

Tax Withholding For Pensions And Social Security Sensible Money

Kentucky Household Employment Tax And Labor Law Guide Care Com Homepay

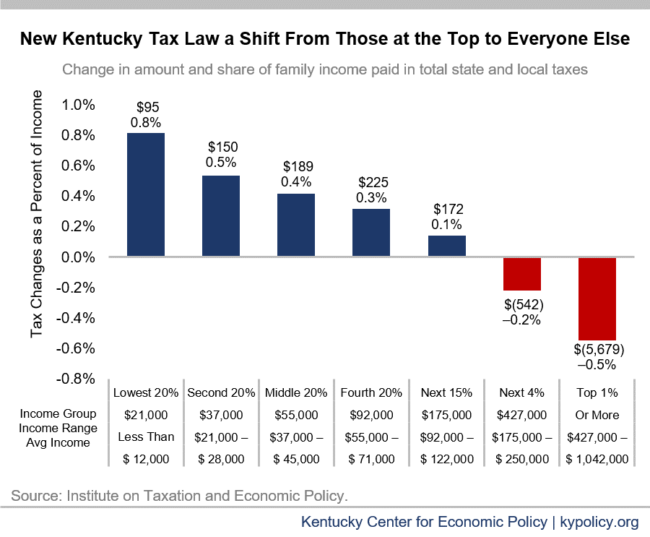

Kentucky Tax Shift Going Into Effect Kentucky Center For Economic Policy

New York Hourly Paycheck Calculator Gusto

Capital Gains Tax Calculator Estimate What You Ll Owe

Dual Tax Status What Does It Mean For Your Pastor American Church Group Kentucky